This session continued the cohort’s exploration of the land development process, focusing on how developers evaluate opportunities through deal structure, pricing, yield, and timing—long before a project ever breaks ground.

The conversation was anchored by Gilbert Gerst, Senior Vice President of Community Development Banking at Bank of Texas, who emphasized three fundamentals that consistently shape development outcomes: what you pay for the land, what you sell it for, and the time in between. From there, the discussion expanded to include how deal structures and evolving information influence risk, feasibility, and long-term value.

Insights from Demarius Seals of DCS Development Services and Jared Helmberger of Bear Land reinforced that land development is an iterative process—one that requires disciplined analysis, adaptability, and an understanding of how product type and yield expectations shift over time.

Earlier in the day, participants also attended the Real Estate Council Forecast 2026, providing broader market context that complemented the session’s focus on land strategy and development fundamentals.

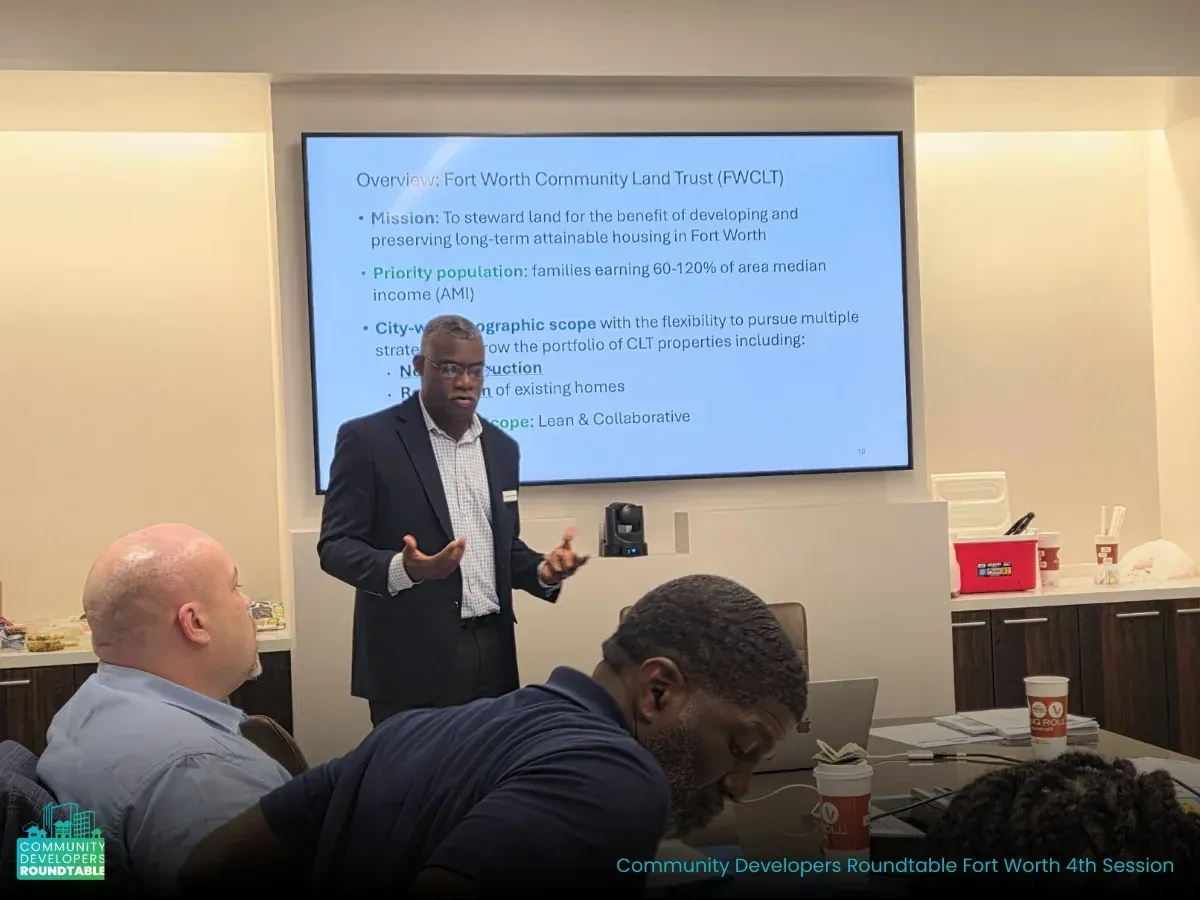

The session concluded with a presentation from the Fort Worth Community Land Trust, highlighting its mission to steward land in support of long-term attainable housing for families earning 60–120% of area median income. The overview underscored a citywide, flexible approach that includes new construction, renovation of existing homes, and a lean, collaborative operating model.

Together, the discussions reinforced land as a strategic asset—one shaped by structure, timing, and intent as much as by location or price.

Together, the discussions reinforced land as a strategic asset—one shaped by structure, timing, and intent as much as by location or price.

To learn more about the CDR Cohort 3 (Fort Worth) participants, click here.